Your investments

If you have any deferred DC benefits (which may include AVCs), you'll have an individual account which is invested with the aim of growing its value through investment returns. Depending on what section you were a member of, your individual account will either be in DC Core, DC Start or an external AVC provider. You can find out which section you're in by contacting Nestlé Pensions.

DC Start

In DC Start, your account is automatically invested in the Lifetime Pathway fund. Your target retirement age is your state pension age. You don't have to make any investment decisions.

If you're in DC Start and you'd like to choose your own investments or change your target retirement age, you'll need to switch to DC Core. You can do this by completing the DC Core Option Form and returning it to Nestlé Pensions.

DC Core

In DC Core, you can choose how your contributions are invested. You can put all your contributions into either:

- the Lifetime Pathway fund; or

- any combination of our selection of individual 'self-select' funds.

If you haven't chosen how to invest your contributions, they will be invested in the Lifetime Pathway fund. While we think this fund will meet the investment needs for most members, it might not be right for everyone. You'll need to think about whether it's right for you and what age you'd like to retire at – this is known as your target retirement age.

The Lifetime Pathway fund

In the Lifetime Pathway fund, your contributions are automatically divided between investment funds and switched to more stable investments as you approach your selected retirement date.

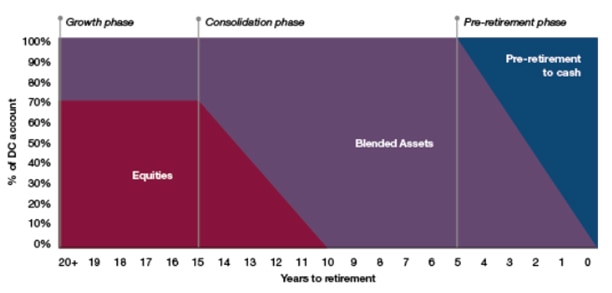

This switching takes place in three phases:

1. Growth

Over 15 years from retirement

Aim:

To grow the value of your investment.

Made up of:

Higher-risk investment funds with the potential for higher returns.

Funds used:

Equities and Blended Assets.

2. Consolidation

From 15 to 5 years from retirement

Aim:

To keep a level of growth and begin to protect the value of the Funds you have already built up.

Made up of:

Medium-risk investment funds with the potential for higher returns while aiming to protect the value of your account.

Funds used:

Blended Assets.

3. Pre-retirement

Less than 5 years from retirement

Aim:

To protect a level of growth and begin to protect the value of the Funds you have already built up.

Made up of:

Lower-risk investment funds to further protect the value of your account.

Funds used:

Blended Assets and Pre-retirement cash.

To find out more about the individual funds, see self-select funds.

This graph shows how the automatic switching starts to move your investments once you are 15 years away from your target retirement age:

Automatic switching and your TRA

Changing your target retirement age

If you're invested in the Lifetime Pathway, your target retirement age is the age you've told us you'd like to retire at and we use it to work out when we need to start switching you out of higher-risk investments.

You can see how your investments gradually start to switch into more stable funds as you approach your target retirement age in the 'Automatic switching and your TRA' graph.

Your target retirement age doesn't have to be the same as your normal pension age in the Fund.

If you change your target retirement age while you're in the consolidation or pre-retirement phases shown above, we'll need to adjust the ratio of your higher-risk to stable investments to reflect how close you are to your new target retirement age. We do this by buying and selling investments until you have the right mix of higher-risk and stable investments again.

You can change your target retirement age by completing a Target Retirement Age Change Form and returning it to Nestlé Pensions. You can make this change whenever you like, but we process these forms every February, May, August and November.

You can also complete this form online by logging into your Online Account.

What does it cost?

To cover the cost of managing your investments, a percentage of the total value, known as the annual management charge, is automatically taken out of your DC account via an adjustment to the unit prices. Other charges may apply to certain funds. The annual management charge plus the other annual charges give the total fund charge, which is known as the total expense ratio.

Please refer to the fund factsheets for the current total expense ratio.

During the three phases of the Lifetime Pathway, the charges are currently:

Growth phase

Total expense ratio: 0.33%

Consolidation phase

The total expense ratio increases from 0.33% to 0.65% between 15 and 10 years before retirement as your DC account gradually moves into the Blended Assets fund. The total expense ratio stays at 0.65% from 10 to 5 years before retirement.

Pre-retirement phase

The total expense ratio decreases from 0.65% to 0.34% from five years before retirement as your DC account gradually moves into the Pre-retirement to Cash fund.

Changes to the Blended Assets fund

In September 2021 we replaced one of the underlying funds in the Blended Assets fund. This was because it wasn't performing as well as we expected.

If you are in the Lifetime Pathway, or have invested your pension savings in the Blended Assets self-select fund, this will affect you.

The Blended Assets fund was previously made up of:

- 50% Invesco Global Targeted Returns Fund

- 50% Schroders Diversified Multi Asset Fund

Following the review, the Blended Assets Fund is now made up of:

- 37.50% Schroders Diversified Multi Asset Fund

- 12.90% SSGA Global Multi-Factor Strategy

- 2.10% SSGA Emerging Markets Equity Index Fund

- 38.13% PIMCO GIS Income Fund

- 9.37% L&G All Stocks Gilt Index Fund

As result of this change, we hope to deliver better outcomes for our members, by providing:

- Lower investment fees – so that you pay less costs and charges during the time that your pension savings are invested in the Fund.

- Investment returns that are the same or better but that have a lower risk profile.

The fund factsheet for the new Blended Assets fund isn't available yet. It should be available in early March 2022.

Self-select funds

If you'd prefer to select your own investment funds, you can choose from our self-select funds options below. These funds don't automatically move your investments into lower-risk investments as you approach retirement, but you can move your investments yourself. For more information, see Changing your funds.

Equities

Cash

Blended assets

Corporate bonds

Ethical consolidation

Ethical growth

Pre-retirement to annuity

Pre-retirement to cash

Property

Shariah

Changing your funds

As your attitude to risk may change over time, you may also want to change your investment choices. That's why it's important that you regularly review your investment choices to ensure that they are still right for you.

In DC Core, you can change your investment choices quarterly by completing a Deferred Member Investment Choices Form and returning it to Nestlé Pensions.

When you change your investment choices, you have various options:

- to invest in the Lifetime Pathway fund – in this case, all of your account (either your Main account or your AVC account) must be invested in the Lifetime Pathway;

- to invest all your DC Core account in any combination of our self-select funds; or

- to change the way your account is split across the self-select funds you have chosen.

If you select the Lifetime Pathway option, you also need to select the age at which you would like to retire – or a target retirement age. This can be any age from age 55 to 75 and can be different to your Normal Pension Age. If you do not select a target retirement age, we will use your current Normal Pension Age.

If you change your investment choices, all of your DC Core account will be invested in line with your new investment instructions. If you built up Additional Voluntary Contributions while you were an active member of the Fund, you can invest them differently to your main contributions.

If you ask to change your investment choices, we will sell the units you hold in your current funds and use this money to buy units in the new funds you have chosen.

The costs of buying and selling units

You won't be charged for switching funds, but if you decide to change funds there are costs that need to be paid when selling units in your old funds and buying units in your new funds. These costs are included in the daily unit price of each fund. Our investment provider will try to keep these costs as low as possible, but this may not always be possible.

The fund manager may take steps to make sure that existing investors are protected by 'swinging' the unit price. This means that only the member who is making a transaction on a particular day pays the sale and purchase costs, which could both be as much as up to 1% of the value of the money being disinvested and reinvested.

Generally, our investment provider will be able to sell and buy units on the same day, so that you are constantly invested in the financial markets – but sometimes this won't be possible. If this happens, our investment provider will sell units one day and purchase new units a few days later. If this happens, your money will be 'out of the market' between the sale and the purchase date. As a result, you could either make a gain or a loss if the markets move while you are out of the market.

If you would like advice about your investment choices, you should contact an independent financial adviser. You can find one using MoneyHelper's directory of advisers who are authorised by the Financial Conduct Authority.

Information about the funds

Our investment provider, Fidelity, prepares information on each of the funds in a fund factsheet. The factsheets include the objective of the fund, its risk rating, where it is invested, the fund charges, and the fund performance. Fidelity updates the factsheets each quarter and new factsheets are generally available about eight weeks after the end of each quarter.

Fund factsheets

The following fund factsheets from Fidelity give more information about the available funds.

Growth Please note that the Growth fund is only available through the Lifetime Pathway, so you won't be able to choose it as a self-select option. Equities Property Blended Assets Corporate Bonds Pre-retirement to annuity Pre-retirement to cash Cash Ethical Growth Ethical Consolidation Shariah