Your Pension

Overview of sections

Your pension builds up differently depending on which section of the Fund you’re in. To see information relevant to you, choose your section.

DC Start and DC Core

In DC Start and DC Core, you and Nestlé pay a percentage of your salary into your account and it is invested to help it grow. You can then choose how to use the money in your account when you retire. This type of benefit is known as defined contribution (DC).

See Contributions from you and Nestlé for more information about how much you can pay, and what your options are.

DB Core and DB CorePlus

In DB Core and DB CorePlus, you build up pension based on your salary up to a certain level (known as the pensionable earnings cap). When you retire, we work out your pension based on an average of your pensionable salary over time (known as your career average revalued pensionable earnings), and the length of time you have been a DB Core or DB CorePlus member of the Fund. To receive this benefit, you pay a set percentage of your salary into the Fund. This type of benefit is known as a defined benefit (DB).

This page explains more about how much you pay, and how your pension will be calculated.

Whichever section you’re in, you’ll also receive benefits if you become too ill to work and your dependants could receive benefits after you die.

Contributions from you and Nestlé

In DC Start

In DC Core

In DB Core

See Sharing the cost for more information about contribution rates to DB Core and how they might change in the future.

In DB CorePlus

See Sharing the cost for more information about contribution rates to DB CorePlus and how they might change in the future.

See below for more information about how much you pay, and how your pension will be calculated.

How we work out your pension

When you leave Nestlé, or retire, we work out your DB Core and/or DB CorePlus pension. To do this, we take into account three things:

The average of your pensionable earnings over the time you’ve been a member of DB Core and/or DB CorePlus. We increase this to allow for inflation between when you joined and when you leave or retire to give your career average revalued pensionable earnings (see below);

The number of years you’ve been a member of DB Core/DB CorePlus; and

The rate that you build up pension in DB Core/DB CorePlus (known as the ‘accrual rate’).

We put these three things into a formula to work out your pension.

For DB Core the formula is:

For DB CorePlus the formula is:

This amount is paid to you each year of your retirement until you die.

Career average revalued pensionable earnings

So that your pensionable earnings each year don’t lose value because of inflation, we increase, or revalue, your pensionable earnings in line with the consumer prices index (CPI), up to a maximum of 2.5% a year, from the end of that year until you leave or retire. We then add each year’s revalued pensionable earnings together and divide them by your number of years of pensionable service in DB Core and/or DB CorePlus to give your career average revalued pensionable earnings. Nestlé may revalue your pensionable earnings above 2.5% but is not required to.

Example

Jane retired at her normal pension age on 31 July 2020 with three years’ pensionable service. In the three years before retirement, Jane’s pensionable earnings were £25,000 in year 1, £26,000 in year 2 and £27,000 in year 3. When Jane retired, CPI had been 2.5% each year over her period of service.

Jane’s pensionable earnings were revalued as follows:

Year 1

Pensionable earnings revalued for 2 years:

Year 2

Pensionable earnings revalued for 1 year:

Year 3

Pensionable earnings (not revalued in the last year):

And Jane’s career average revalued pensionable earnings were calculated as follows:

Pensionable earnings cap

What is the pensionable earnings cap?

The pensionable earnings cap means that if you earn more than £51,647 in any year:

- the contributions you pay from your pensionable earnings up to £51,647 are used to build up DB Core or DB CorePlus benefits for that year; and

- the contributions you pay from your pensionable earnings above this amount are used to build up savings in DC Core.

Does it affect you?

If you’re in DB Core or DB CorePlus and your pensionable earnings are above £51,647, the pensionable earnings cap affects you.

If you’re close to the cap, or think you might go over it in the future, you might want to find out more. You can do this at any time by contacting Nestlé Pensions.

The pensionable earnings cap is currently £51,647 and will be increased at the beginning of each scheme year (which runs from April to March) in line with the consumer prices index up to a maximum of 2%. If you’re in DB Core or DB CorePlus, Nestlé will tell you what the new pensionable earnings cap is for the next scheme year.

How does it work?

Here’s how the pensionable earnings cap works in practice based on a full scheme year (April to March).

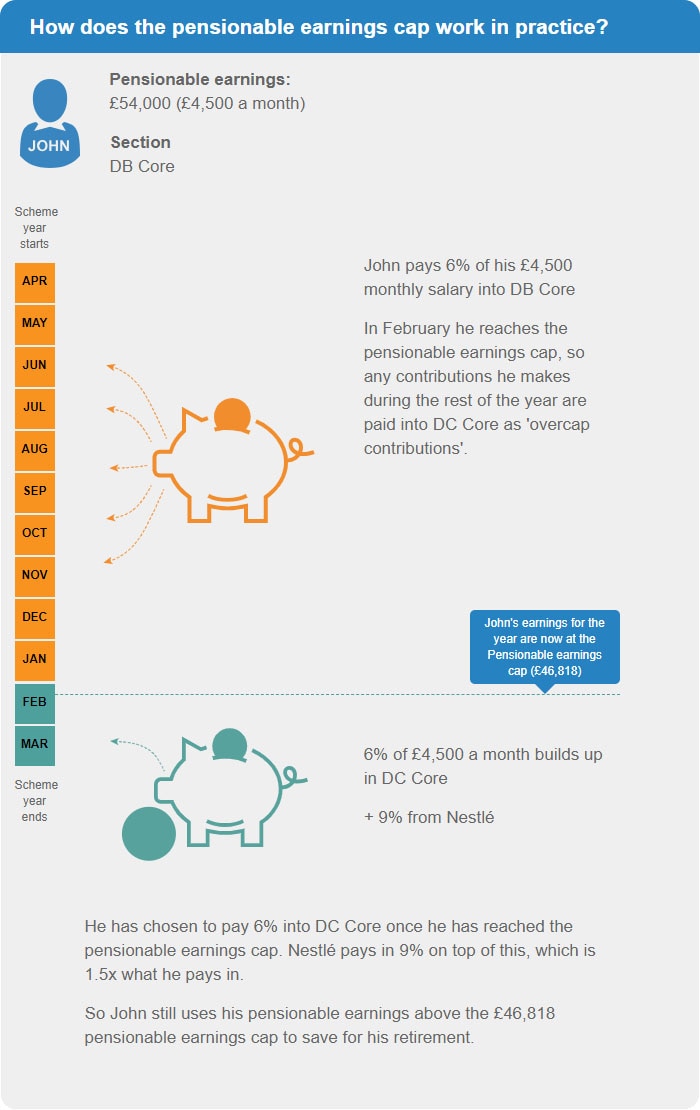

How does the pensionable earnings cap work in practice?

John’s pensionable earnings:

£54,000 (£4,500 a month)

Section

DB Core

John pays 4.6% of his £4,500 monthly salary into DB Core

In February he reaches the pensionable earnings cap, so any contributions he makes during the rest of the scheme year are paid into DC Core as 'overcap contributions'.

6% of £4,500 a month builds up in DC Core

+ 9% from Nestlé

He has chosen to pay 6% into DC Core once he has reached the pensionable earnings cap. Nestlé pays in 9% on top of this, which is 1.5 times what he pays in.

So John still uses his pensionable earnings above the £51,647 pensionable earnings cap to save for his retirement.

You can choose to pay between 5 and 8% into DC Core once you reach the pensionable earnings cap, and Nestlé will pay 1.5 times this amount into your DC Core account on top of this.

To change how much you pay into DC Core once you've reached the pensionable earnings cap, please contact Nestlé Pensions.

How much do you pay to DC Core if you earn above the cap?

You can choose to pay between 5% and 8% of your pensionable earnings above the cap to DC Core. If you have not told us how much you would like to pay to DC Core:

- If you are in DB Core, you will pay 6% of your pensionable earnings to DC Core.

- If you are in DB CorePlus, you will pay 8% of your pensionable earnings to DC Core.

Nestlé pays 1.5 times your contributions.

You can change the level of contributions you pay on your pensionable earnings above the cap (known as overcap contributions) once a month. If you want to do this, please contact Nestlé Pensions.

See Your investments for more information on how your contributions to DC Core are invested.

To change how your contributions to DC Core are invested, fill in and return an Active Member Investment Choices Form.

Sharing the cost

As DB Core and DB CorePlus are defined benefit (DB) arrangements, Nestlé pays whatever is needed on top of your contributions to provide the pension you build up. To share some of the risk involved with providing this type of pension, there is a contribution sharing arrangement in place, which means that contribution rates to DB Core and DB CorePlus might change by going up or down in the future.

- In DB Core, Nestlé pays two-thirds and members pay one-third of what is needed to pay members’ benefits. From 1 January 2026, this is 9.3% of pensionable earnings for Nestlé and 4.6% of pensionable earnings for members.

- In DB CorePlus, Nestlé makes the same contribution as it does for DB Core and members of DB CorePlus pay the remaining amount that is needed to pay members’ benefits. From 1 January 2026, this is 9.3% of pensionable earnings for Nestlé and 8.0% of pensionable earnings for members.

Nestlé and member contribution rates for DB Core and DB CorePlus are reviewed after each actuarial valuation, so it’s likely they will change (increase or decrease) again in the future, Valuations act as a financial health check of the Fund and they normally take place every three years.

If member contribution rates do change following a future valuation, we’ll give you as much notice as we can so you have time to consider your options. These include reviewing the contributions you make, considering whether to switch sections, or whether to start making or increase or decrease the amount of additional voluntary contributions you’re making.

To find out how you can take your benefits at retirement, see ‘Approaching retirement’.

Find out with the "understanding your pensions" guide by nudge.

Getting to grips with pensions can often seem like hard work but it doesn't have to be. This guide will introduce you to the basics, including workplace pensions and the state pension.

Log in today to get started on the "understanding your pensions" guide by nudge.